Confidence built on tailored protection

Tailored policies designed to transfer risk while keeping you in control of costs.

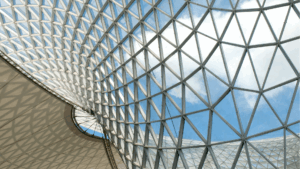

Construction Insurance

As specialist construction insurance brokers, we provide bespoke insurance solutions to protect your projects and bottom line.

Expert Construction Insurance Solutions

The construction industry is dynamic, brimming with potential yet fraught with inherent risks. We don’t believe in one-size-fits-all solutions. Leveraging our deep understanding of the sector, we craft tailored policies that effectively transfer risk while ensuring you are in control of the premiums.

Comprehensive Project Protection

From groundbreaking to completion, we provide comprehensive coverage for all stages of construction. Our expertise extends to contractors’ all-risk insurance, employers’ liability, professional indemnity, and public liability coverage. As Lloyd’s brokers, we have access to exclusive markets, enabling us to secure competitive terms for complex risks.

Tailored Risk Solutions

Every construction project faces unique challenges. We take time to understand your needs, from site conditions to contract requirements, ensuring your insurance program aligns perfectly with your risk profile. Our solutions protect against standard risks and project-specific challenges, providing complete peace of mind.

Cost-Effective Coverage

While comprehensive protection is essential, we understand the importance of managing costs. Our strong market relationships and technical expertise enable us to negotiate competitive premiums without compromising coverage. We work closely with you to balance protection and premium, ensuring value for money.

Risk Management Expertise

Beyond insurance placement, we provide valuable risk management advice to help minimise potential claims. Our team’s expertise in the construction sector allows us to identify potential risks early, recommending practical solutions to protect your projects and maintain favourable insurance terms.

Claims Support

Our dedicated claims team provides robust support to ensure swift resolution when incidents occur. Effective claims handling is crucial in the construction sector, where delays can significantly impact project timelines and costs. Our experienced professionals work diligently to achieve the best possible outcome for your claim.

Build with Confidence

Contact our construction insurance specialists today to discuss your project requirements. Whether you’re planning a new development or reviewing existing coverage, we’re here to help protect your interests.

Call us on 01702 543 306 or complete our online enquiry form for expert advice tailored to your needs.

“What sets us apart is our team of dedicated professionals who have broad technical market expertise and are committed to exceeding your expectations. We go beyond simply providing insurance; we become your trusted partner, empowering your business to thrive. It’s why our clients choose us, time and again.

If you have a risk which you need help with, don’t hesitate to get in touch.”

Elaine Barclay,

Managing Director – Retail

BLW Insurance Brokers

Insights and Updates

Stay informed with expert advice, industry insights, and the latest updates.

The Insurance Charity – Our Dedicated Industry Charity

Learn about the Insurance Charity Awareness Week 2025 and how this essential organisation supports UK and Irish insurance professionals facing financial difficulties. Discover eligibility, support options, and ways to get involved. #ICAW

Specialist Efficacy Cover: A Solution for Your High-Value Security & Electrical Clients

When high-value electrical and security systems fail to perform as intended, the potential liability for your premium clients can reach millions—far beyond what standard market capacity provides. BLW’s exclusive London Market efficacy cover through Chaucer delivers the comprehensive protection your £10,000+ GWP clients need, with specialist capacity that standard facilities simply cannot match.

Insurance for Temporary Structures

From pop-up film studios to glamping pods, temporary structures represent millions in investment but create unique insurance challenges that standard commercial policies can’t address. BLW’s exclusive Entertainment and Leisure wording provides comprehensive coverage specifically designed for the mobile, seasonal nature of these sophisticated modular installations.

The Value of Independence in a Consolidating Market

BLW Insurance Brokers CEO Brett Sainty discusses the value of independent brokers, their heritage expertise, market trends, and balancing technology with personal service.

BIBA 2025 Manifesto Launch: Partnering to Deliver Value

Discover BIBA’s 2025 Manifesto, outlining key initiatives, regulatory reforms, and industry collaboration to support growth, tackle emerging risks, and enhance the role of insurance brokers in a changing market.

Alarminsure – Specialist Insurance for Security Installers & Electrical Contractors

Discover how Alarminsure simplifies insurance for security and electrical contractors, offering tailored cover, expert advice, and peace of mind to keep your business protected.